Chapter Links (Timestamps)

- Intro (0:00)

- Home loan eligibility criteria (01:15)

- Credit cards (3:25)

- Building credit record (04:32)

- Age requirements (05:37)

- Main exception (07:27)

- Married to Ecuadorian loan criteria(09:54)

- Interest rates (11:00)

- VIP loans (11:40)

- VIP loan process (14:41)

- VIP loan downpayments (19:32)

- VIP loan assistance (20:32)

- Last tips (24:08)

Welcome, YapaTree viewers! Today, we delve into a crucial topic that has piqued the interest of many expats – securing home loans in Ecuador. I’m your host, Jason, and I’m joined by one of YapaTree’s real estate experts, Xavier. Our collaboration on numerous real estate transactions in Cuenca has exposed us to one of the most common inquiries from expats: How does real estate financing in Ecuador function, especially in comparison to the United States?

In this article, we will dissect the intricacies of expats obtaining loans in Ecuador, shedding light on the challenges and strategies that can make homeownership a reality for those considering life in Cuenca.

Understanding the Challenges

Xavier starts by emphasizing the challenges that expats face when seeking loans in Ecuador. He points out that to qualify for a loan, you must be an Ecuadorian citizen. Temporary or permanent residency doesn’t cut it, which can be a considerable hurdle for many expats.

“Well, number one, to get a loan in Ecuador, you gotta be an Ecuadorian, OK? If you’re an American or a Canadian or a European just looking for a loan, it’s not going to be possible,” Xavier explains. So as a temporary resident or permanent resident, obtaining a loan remains out of reach. Ecuadorian citizenship is the key, but the process can be complex, especially for those under 65.

While many expats might be tempted to draw parallels with loan processes in their home countries, Xavier underscores a crucial distinction: “You’ve got to build a credit record here in Ecuador, not the credit record in the US.” The absence of credit history from other nations, even if impeccable, counts for little in the Ecuadorian context. To build a credit record, one must begin by securing a credit card, a task easier said than done. Xavier continues, “You’re going to have to put a CD against the credit card. Let’s say a $5000 CD, and you will get a $3000 credit card open.” This is a far cry from the straightforward credit card applications that many expats may have encountered in their home countries. The importance of adapting to the local financial landscape and understanding these nuances cannot be overstated.

Building a Local Credit Record

Building a credit record in Ecuador is a pivotal step in securing a home loan as an expat. Xavier emphasizes that this process significantly differs from credit records in other countries. One distinctive aspect lies in the source of income that can be considered. Whether it’s income from local employment, earnings from the United States, or retirement income, Ecuadorian banks acknowledge various sources of revenue. The primary criterion here is consistency. To convince lenders, it’s imperative that your income stream is regular and dependable.

Xavier further elucidates the unique intricacies involved in building an Ecuadorian credit record. Jason asks, “Clients will come to us and say, ‘Look in Canada, my rating is XXX.’ Does that matter here?” Xavier response with a simple, “No, unfortunately, it really doesn’t.” This stark reality calls for a shift in perspective for expats. The familiar benchmarks from their home countries hold little sway in Ecuador, emphasizing the need to adapt to the local financial landscape.

To prove your creditworthiness in Ecuador, you’ll need to build a local credit record, which is quite different from credit records in other countries. “It doesn’t matter. It could be local income, US income, or retirement income,” Xavier notes regarding the source of income. The key is having a regular income, either from working in Ecuador or from external sources.

The requirement to demonstrate regular external income, such as monthly wire transfers to an Ecuadorian bank account, is another distinctive feature of securing a loan in Ecuador. Xavier underscores, “You know, even Western Union records work.” This provision caters to the diverse profiles of expats, acknowledging that income sources can vary widely. It’s not just about a nine-to-five job; it’s about building a comprehensive financial portfolio that can meet the criteria set by Ecuadorian banks. Xavier’s guidance in this regard provides a roadmap for expats to align their financial affairs with Ecuador’s lending landscape.

For expats residing in Ecuador and actively working, the path to building a credit record involves making purchases on credit, utilizing credit cards, or securing a loan. These financial activities contribute to the gradual construction of a credit history. However, for many expats, especially retirees, this pathway can be less feasible, as their financial circumstances may not necessitate such transactions. Thus, understanding alternative methods becomes essential.

If you aren’t actively working within Ecuador, as is often the case for retirees, your options for building a credit record can be limited. This is where external income sources play a crucial role. Regular, reliable income from external avenues, like monthly wire transfers to your Ecuadorian bank account, can substantiate your creditworthiness. It provides lenders with a tangible indicator of your financial stability, even if you’re not part of the local workforce.

Age Requirements

One of the notable hurdles for expats looking to secure loans in Ecuador is the age requirement. Xavier explains, “By the time you finish paying your loan, you cannot be older than 75 years old.” This means that if you’re under 65 and considering obtaining a loan, you need to time your application carefully to ensure you can meet this age requirement when the loan is paid off.

The Marriage Exception

Xavier points out an exception to the challenging loan requirements for expats, and it’s a rather unique one: “Yeah, there’s one little trick. Get married.” Being legally married to an Ecuadorian citizen automatically establishes your credit record, making it easier to secure a loan. Whilst this advice is largely tongue-in-cheek (please do NOT get married just to get a loan), it does open up home loans to those that have an Ecuadorian spouse.

The marriage exception in Ecuador, allowing expats to secure home loans more easily, comes with a twist. Once you are legally married to an Ecuadorian citizen, Ecuadorian law dictates that you and your spouse each own 50% of any property and any accompanying debts. This marital property regime underpins the reason why your spouse’s creditworthiness can significantly impact your ability to obtain a home loan.

In practical terms, this means that your Ecuadorian spouse’s credit history becomes inherently linked to your own financial journey in Ecuador. If your spouse has a stellar credit record, it can work in your favor, facilitating the loan application process and potentially leading to more favorable terms. Conversely, if your spouse’s credit record has blemishes, it could pose challenges when seeking a home loan.

The VIP Loan Program

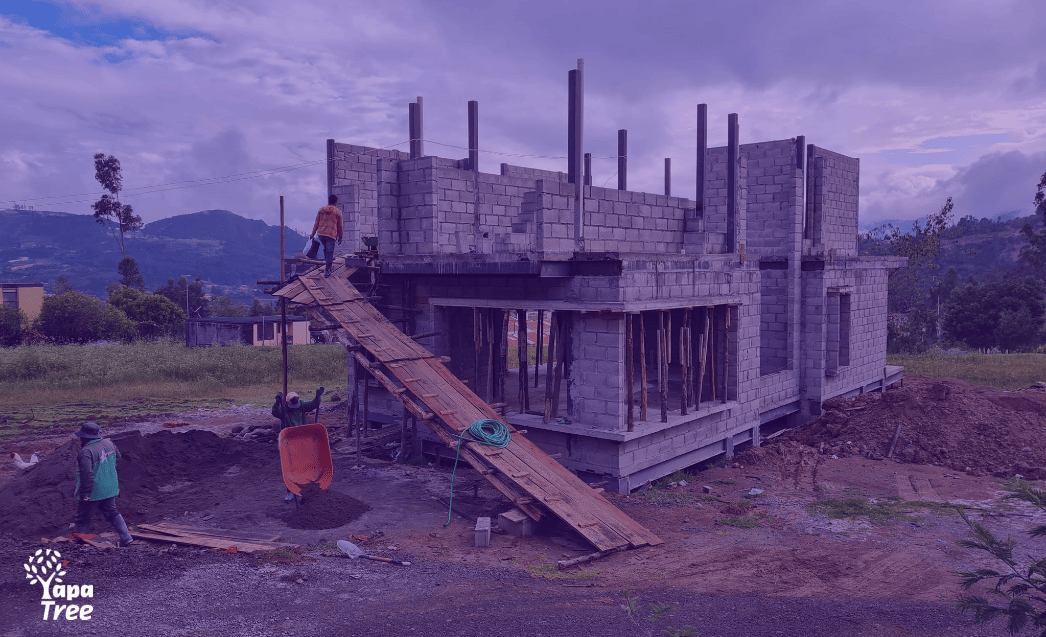

For expats in Ecuador, particularly those married to Ecuadorian citizens, the VIP Loan Program can be a ray of hope in the challenging landscape of home loans. This program is specifically designed to make home ownership more attainable for Ecuadorians on modest incomes. Think of it like a starter home program. To be eligible for the VIP Loan Program, a combined income of the applicants between $1,500 and $2,800 per month is required. This income range offers a crucial window for many expats, especially retirees, who often fall within this bracket.

However, it’s important to note that there’s a catch, as Xavier points out: “And if you’re earning too much money, they just say no.” This intriguing aspect of the VIP Loan Program is a double-edged sword. While it’s undoubtedly beneficial for those with modest incomes, it can pose challenges for those whose combined income exceeds the program’s upper limit. In such cases, the program may not be accessible, and applicants might have to explore alternative loan options, which can come with different terms and conditions.

For those who fall within the prescribed income range, the VIP Loan Program can be a game-changer, while others may need to explore alternative financing solutions that suit their specific circumstances.

VIP Loan Details

The VIP Loan Program, as outlined by Xavier, brings a unique opportunity for expats in Ecuador, offering a path to affordable homeownership. “The VIP is the 1st house that you can buy, and then the government is gonna subsidize the cost of the money, the cost of your loan. So the rate is gonna be 4.9% on average,” Xavier explains. This crucial detail sets the VIP Loan Program apart, as it provides eligible buyers with favorable interest rates, making it significantly more affordable compared to traditional loans. The lower interest rate can be particularly enticing for those looking to invest in a first home in Ecuador.

Regarding the down payment for VIP loans, Xavier adds, “Well, usually it’s going to be $5,000, OK. It is usually $5,000. However, it’s going to depend on the price of the property.” This low down payment requirement, often fixed at $5,000, is another advantage for expats seeking to enter the housing market. However, the down payment’s flexibility concerning the property’s price can be especially beneficial. It allows potential homeowners to adapt their financial commitment to the specific cost of their chosen property, making the VIP Loan Program more accessible and accommodating for various budget ranges.

VIP Loan Assistance

Xavier’s commitment to helping potential homeowners navigate the VIP loan process is a valuable resource for expats seeking to make homeownership in Cuenca a reality. His offer of assistance can significantly ease the administrative and paperwork burdens associated with securing a VIP loan. Notably, Xavier mentions, “If you’re buying real estate from me, it has no cost.” For those who choose to work with YapaTree as their real estate agent, his guidance and support in obtaining a VIP loan come as a part of the service.

However, for individuals who opt to find their property independently, outside of YapaTree’s services, there may be associated fees for his assistance in managing the intricate administrative and paperwork requirements essential for securing a VIP loan. These fees are worth considering, as they can streamline the process and increase the likelihood of a successful loan application. Xavier’s expertise in this field is built on nearly 20 years of experience as a real estate agent, during which he has successfully guided numerous expats through the loan application process, with only two cases failing to secure a mortgage during his entire career.

Success Stories and Challenges

Xavier, drawing from his extensive experience as a real estate agent, offers some valuable insights into the world of home loans in Ecuador. He begins by encouraging those considering applying with a heartfelt piece of advice, “Like an advice, well, just move to Ecuador, it’s wonderful. It’s a great place to live in Cuenca, in particular.” His recommendation to relocate to Ecuador, and Cuenca in particular, underscores the allure of this beautiful city as a place to call home.

Furthermore, Xavier underlines a key aspect of obtaining a home loan in Ecuador, particularly for those looking to rely on their spouse’s Ecuadorian citizenship for eligibility. He highlights the importance of being married for at least six months before applying for a loan, and he wisely advises against rushing into a marriage solely for the purpose of obtaining a loan. This cautionary advice aligns with the magazine’s commitment to providing ethical guidance to its readers, ensuring that their decisions are driven by genuine intentions rather than solely for financial gain.

In the landscape of home loans for expats in Ecuador, Xavier acknowledges the inherent challenges. However, he also highlights exceptions and strategies that can ease the complexities of the local lending system. The VIP Loan Program, specifically tailored for those married to Ecuadorians, offers a beacon of hope for potential homeowners. This program, with its favorable interest rates and lower down payments, has helped numerous expats fulfill their homeownership dreams.

Wrapping Up

While securing a loan as an expat in Ecuador can be challenging, there are exceptions and strategies, such as the VIP Loan Program and being married to an Ecuadorian, that can help navigate the complexities of the local lending system. It’s essential to understand the requirements and seek professional assistance to improve your chances of success in obtaining a home loan in our fair city of Cuenca.

Got questions or need help with your home loan? Feel free to contact us.

Further reading:

- Cuenca Real Estate

- Cuenca Apartments for Sale

- Cuenca Apartments Rent

- Cuenca Events

- Pet Adoptions

- Cuenca Deals

View full video transcript

Expat Home Loans in Ecuador (incl VIP Loans) – Transcript

Jason 00:00

Hello, YapaTree viewers, welcome back to our channel. Today we have a special topic that many of our expat readers have been curious about – home loans in Ecuador for expats. I’m your host, Jason, and joining me is our main real estate agent, Xavier. Xavier, thanks for being here today. You and I work together on a lot of real estate deals here in Cuenca and one of the most persistent questions we get is how does real estate financing work? Does it work the same way as it does in the US? Can I get a mortgage or similar type questions? Can you just briefly explain the general situation when it comes to expats obtaining loans in Ecuador?

Xavier 00:41

Hello, Jason. Hi, everyone. Yes, that’s a very common question that we have from our customers. However, I have to tell you that it’s not really easy to get a loan for an expat. I’m not saying it’s impossible, but it’s not easy. Many agents are going to tell you that it’s not possible but we have found out that there are some ways an expat can get a loan or a mortgage. I will explain that later.

Jason 01:15

I think I do wish it was easier for expats to obtain financing here. Can you just walk us through some of the eligibility criteria that you mentioned?

Xavier 01:25

Well, number one, to get a loan in Ecuador, you gotta be an Ecuadorian, OK? If you’re an American or a Canadian or a European just looking for a loan, it’s not going to be possible.

Jason 01:37

So as a temporary resident, I couldn’t get a loan here?

Xavier 01:41

No.

Jason 01:41

As a permanent resident?

Xavier 01:46

No. Has to be a citizen. Ecuadorian citizenship. And that takes a while.

Jason 01:51

It can be tough for those, especially with the change in the rules and the questions.

Xavier 01:56

Yeah, they change the rules every once in a while.

Jason 01:59

Yeah, so for under sixty five in particular, I think it is quite hard with the current test they have for that.

Xavier 02:05

Test you have those Spanish – you have a lot of things to achieve the Ecuadorian citizenship.

Jason 02:11

What else do you need?

Xavier 02:12

The proof of income. You know the proof of income. Also, to get a loan, you got to get a credit record, but you got to build a credit record here in Ecuador, not the credit record in the US.

Jason 02:26

That means next to nothing. I know we’ve had this conversation several times and clients will come to us and say, “Look in in Canada, my rating is XXX.” Whatever that happens to be. Does that matter here? No, unfortunately, it really doesn’t.

Xavier 02:39

It doesn’t matter, actually. And also you got to prove an external income. You know monthly wire transfers to your local bank account.

Jason 02:49

Unless you’re working here, right if you’re working. Here then work here, also building up the credit through the IESS system, but that’s pretty rare for expats to go down that path.

Xavier 02:57

Yes, you get to have a working visa or a citizenship. Actually, citizenship. But you can work and have IEES record, and if you’re working also, you’re going to be building up a credit record through your credit cards or through buying in a homewares store on credit or whatever. Everything is going to be recorded.

Jason 03:25

It’s tough to build a credit record here for expats, even getting like a simple credit card is normally quite difficult as well – almost impossible.

Xavier 03:33

Yeah, one of the first pieces of advice I always give is to get a credit card. Just in case you’re going to be asking for a loan later. But, it’s not easy because they’re not going to give you just a credit card because you’re requesting it.

Xavier 03:49

You’re going to have to put a CD against the credit card. Let’s say a $5000 CD and you will get a $3000 credit card open.

Jason 03:59

So they are available, but it’s definitely a little bit different to what we’re used to, yeah.

Xavier 04:04

And not every bank is going to give you that chance. And then you’re going to need some references from people who live here. You’re going to need some permanent residency or a house and then you have to prove it and stuff like that so it’s it’s tough. It’s tough, it’s not easy. I can give you a hand. I can help you with that to complete all the paperwork and give you a guide.

Jason 04:32

Sure in terms of building that credit record, we’ve talked about this before and you’ve mentioned that there are a couple of different ways and one of those ways is to have that external income. Let’s say you’re getting, I don’t know some sort of some sort of payment from your…

Xavier 04:49

401K.

Jason 04:51

401K or any other stocks or something like…

Xavier 04:55

But it has to be permanently…

Jason 04:57

It has to be regular.

Xavier 04:58

Regular every month or every two months or every week. And you know even Western Union records work.

Jason 05:05

Sure so basically the key point is it needs to be regular income and it needs to be for a period of time. Like generally the the period of time would be?

Xavier 05:13

1 year. At least a year, but if you’re working, that’s going to depend on the kind of credit you’re going to be willing to… But at least a year. We can discuss every single kind of credit or loan in particular with you later or even with anyone who is willing to get a loan, they can give me a call.

Jason 05:37

One of the biggest hurdles here, especially some of our audience, some of the retirees that have come to Cuenca, there is a certain age requirement on the loans. Can you walk me through that?

Xavier 05:48

Yeah, by the time you finish paying your loan, you cannot be older than 75 years old.

Jason 05:56

By the time you finish paying off the entire loan. So if you get a mortgage based on twenty years you have to be fifty five.

Xavier 06:05

Not older than 55 yeah. If you’re 65 you’re going to be electable. If you’re electable up to a 10 years loan.

Jason 06:13

Sure. Ok, so that’s a tough one though. So for expats you need to be a citizen. Which means that it’s difficult for those under 65 to obtain citizenship, like passing the tests and what not. But even if you are under 65 you need to make sure that the loan’s going to be paid out by 75. So you really need to do the timing window in terms of when you can apply and even if you can apply.

Xavier 06:39

Yeah, we have to structure the credit before you present yourself to the bank in a way that they won’t say no.

Jason 06:49

Got it, Got it. And so it’s clearly pretty tough for a lot of expats to meet this criteria.

Xavier 06:56

Even for locals, it’s hard to get credit. I have talked to friends in the US you can get a loan without a mortgage and you can get a 90% loan or whatever just based on a credit record and your income and it’s easy. Here it’s not. You’ve got to put a lot of money down as a down payment minimum 30% down payment. Meet a lot of criteria, be at a certain age. It’s not easy. It’s not easy for anyone.

Jason 07:27

We’re kind of getting into one of the main exceptions that we have. So as an expat looking for home financing, it’s tough. It is really hard but there is one main exception to this rule. Do you mind focusing on that a little bit?

Xavier 07:41

Yeah, there’s one little trick. Get married. I’m not kidding. If you’re married within Ecuadorian, you’re gonna have an automatically credit right and credit record and then we’re gonna build up the credit.

Jason 08:02

So you would have a credit record through the Ecuadorian spouse?

Xavier 08:04

Through the Ecuadorian, yeah. If you cannot be a citizen, and if you’re married. I’m not… don’t take it wrong. Don’t get married that might be not legal.

Jason 08:16

Don’t get married just to get a home loan, let’s be very, very clear.

Xavier 08:23

I know Ecuadorians who get married with Americans to get visas in the US you know it could work, but the idea is if you’re married. And not just union de hecho, not just leaving together, legally married. And it doesn’t matter if you’re legally married in the US or in Ecuador. We will have to record the marriage certificate from the US here in Ecuador, and we’ll take care of that. Then you have the chance to get a loan – the mortgage for your house.

Jason 09:01

Sure, and the loan itself, because we have the spouse involved, is the loan under both parties’ names or would it just be under the spouse’s name?

Xavier 09:10

Nope. It’s going to be on both parties. On both parties and the asset, the house is also going to be in both parties. According to Ecuadorian law, once you get married, whatever you buy is going to be 50% belonging to each one. And also the debt. You know, let’s say I get a credit card or a loan. This is really common for us to get a credit card on our own. And I got twenty thousand dollars credit on my credit card. My wife is also responsible for 50% of that. It’s not fair, but that’s the way it works. 50:50 once you get married. So yeah, get married and get a loan.

Jason 09:54

So if you have an Ecuadorian spouse, what are those requirements in order to get a loan?

Xavier 10:00

Well, proof of income. We have to prove an income that is going to be enough to cover the monthly payment.

Jason 10:10

Can that be internal/external? Does it matter?

Xavier 10:13

It doesn’t matter. It could be local income, US income, or could be retirement income.

Jason 10:22

As long as it’s above the threshold and regular.

Xavier 10:24

Yeah, it has to be regular. Every month, every two months. We need to know – the bank needs to know a regular. It needs to see a regular income, and it has to be up to… the income has to be three times the…

Jason 10:43

Loan repayment.

Xavier 10:45

Yeah. The payment at least three times. That’s an average and just a very close number.

Jason 10:50

Sure.

Xavier 10:51

And it’s your income and your spouse’s income together.

Jason 11:00

In terms of the repayments, you mentioned it needs to be three times whatever the repayment amount is. What sort of interest rates are we generally looking at?

Xavier 11:09

Super high. We use US dollars but we don’t print them. So we have to ask the US government to use money here. And so that has a cost. So on top of that cost, the banks are going to be making their spread, their income. So basically, we have an average of 9% a year.

Jason 11:40

9%. So that’s obviously higher from our countries at the moment. I know Australia is around 4% and there’s a lot of outcry around how high that current interest rate is. But, obviously, in Ecuador it’s a very different system. And so we do have high interest rates here. Obviously on the other side of that, if you’re looking to buy a CD or something like that, that can also help you, those high interest rates because you’re getting around 9 or 10 % on a CD as well. So I have a spouse and I want to apply for a home loan, walk me through the VIP system because I know that it’s a program for a very particular set of properties and it has its own requirements as well.

Xavier 12:23

Ok, the VIP is the 1st house that you can buy and then the government is gonna subsidize.

Jason 12:35

Subsidize.

Xavier 12:36

Thank you. Subsidize the cost of the money, the cost of your loan. So the rate is gonna be 4.9% average. And it can be as long as 25 years and the down payment is also lower. It’s about $5000 and the kind of houses or apartments that are gonna be electable are not in downtown, unfortunately.

Jason 13:08

Why is that? What stops them from being in downtown? Is that the maximum amount per property that is available?

Xavier 13:14

Well, number one, the price has to be less than $107,000. OK. The price per square meter, including the land and the outsides and the construction has to be around $1000 – a little bit on top of that per square meter. About $100 per square foot, which is really low even for us, you know. And some other criteria, but those two main criteria are going to make the VIP houses or apartments to be in the outskirts of Cuenca, in certain areas. So they have to be qualified by the government, MIDUVI, the Ministerio de Vivienda, – Ministry of Housing, whatever its name. And Yep, you got to provide proof that you don’t have a house.

Jason 14:18

How do you do that? Prove you don’t own, like a title search with your name or?

Xavier 14:24

Well, it’s basically a title search with your name on the Registro de Propiedad. You can do it online if you want. It’s going to be less than $10 – super inexpensive. But if you can not do it, we have somebody who can just fill out the paperwork for you.

Jason 14:41

Sure, so that’s a good point in terms of the process itself, how does getting one of these loans work? So I want a VIP loan. I just go to a bank. I don’t know, Pichincha, and say can I get a VIP loan or how does it work?

Xavier 14:55

Well, you can do that and they will give you the requirements that you have to present and they will take your paperwork and they will put in the stamp saying “OK” or “Denied”. But you could be electable and still be denied. But what you got to do is organize your paperwork in a way that they won’t say no. Pichincha, Mutalista Azuay, I work very much with them. Mutalista Pichincha, also in some other co-ops. OK, for you to be electable, you can’t have a house that you live in. You might own a piece of land, doesn’t matter, but you cannot have a house or a condominium.

Jason 15:48

What about a house in another country, for example?

Xavier 15:51

That’s fine, because the law refers… it’s not just they can check the law refers to owning a house in Ecuador. Ok, so that doesn’t matter if you own a house in the US. Here’s the trick. You cannot have an income less than $1,500 and over $2,800 per month.

Jason 16:21

So you got a window between fifteen hundred and twenty eight hundred dollars, combined income, right?

Xavier 16:27

Yes combined, between you and your spouse, wife. .

Jason 16:33

So if you’re earning too much money, they just say no, or they give you different terms or how does that?

Xavier 16:37

They will say no, you’re not electable for a VIP. You don’t get a subsidized loan.

Jason 16:43

So here’s our 10 % loan, go for it?

Xavier 16:47

Well, it’s not just 10%. We have loans – it depends on your profile. I can get you loans even at 6.7%. Regular loans with 20% down payment, but it’s going to depend on your profile. I have to check not just your profile, I have to check your spouse’s profile basically and see how does it work. And 6.7 is really low.

Jason 17:14

Yes, sure. In terms of the 5 % that’s locked like let’s say the VIP loan that’s locked in for the duration?

Xavier 17:23

Yeah, there’s going to be an update on the interest rate, but it’s not going to get up to six. Probably 5 – 5.1 or whatever, but it’s locked – it’s pretty much on that.

Jason 17:36

Sure, and you did mention previously that there is potential to use your taxable income to prove your credit history overseas, so how does that side of things work? I’ve got my IRS tax refund from years gone by and that just proves my income or how does that benefit..?

Xavier 17:58

Of course. OK, we have local IRS. We call it SRI and the US IRS. So the US IRS – the income tax payments. Of course, we’re gonna need them. At least three years of proof. But the local IRS is also gonna be needed.

Jason 18:17

Got it, got it. And if you’re working overseas, for example, what would you generally recommend in terms of, again, being able to show that credit history?

Xavier 18:27

Well, it doesn’t matter. As long as you have an Ecuadorian spouse, it doesn’t matter where you work, OK? And it’s going to depend on where you work. If you work in the US, well, it’s going to be the income tax, for three years. We’re going to need your boss’s phone number and reference letter, making clear how much you make a week or a month.

Jason 18:53

Sure. What else do we generally need? My understanding is the basic stuff – you’re gonna need your cedula, your passport.

Xavier 19:02

Yeah, your ID. If you own a car, here also. We’re going to need your bank statements, probably, to prove your income because I understand that not many people work on a regular basis. Some of them are not going to be working and making declarations here. So your bank statements. Doesn’t matter if they’re local or overseas, they’re going to be fine. Six months usually.

Jason 19:32

What sort of down payments do clients need to put on for the VIP loans in particular?

Xavier 19:38

Well, usually it’s going to be $5000, OK. It is usually $5,000. However, it’s going to depend on the price of the property. If the price of the property is a little bit higher, which usually happens because Cuenca is really tough to get a $107K house. Probably you can get one at 115. What you have to do is the $5000 plus the difference between.

Jason 20:07

Ok, so you only get a loan for the hundred and seven thousand dollars?

Xavier 20:11

Actually, the house qualification at the government has to be $107K this year because that’s based on the minimum salaries, minimum wage. Next year is going to be different, but the loan is going to be about a hundred and two thousand dollars. So you got to cover the difference.

Jason 20:32

I understand. Anything else or any additional costs that someone who wants to apply for one of these VIP loans needs to know about? Like an application fee for example.

Xavier 20:45

Well, if you’re buying from me, it has no cost.

Jason 20:50

So your assistance in helping to obtain one of these loans is basically free and it’s just part of the deal?

Xavier 20:56

Part of the deal, part of my service. If you’re not buying from me, of course there’s a fee.

Jason 21:04

So if someone finds their own property covered under the VIP loan and they’re just stuck and like, “I don’t know how I’m gonna get through this loan process”, they can reach out to you and you’ll charge some sort of fee for helping with the admin and paperwork.

Xavier 21:16

Of course. And we’ll put everything together and and they pay me a fee. And you know, in my almost 20 years of work as an agent, I’ve only failed 2 mortgages.

Jason 21:34

Why did they fail?

Xavier 21:35

Well, one of them was a pre-qualified customer and then he bought a car on the credit so his credit thing…

Jason 21:45

He used up his credit on the car.

Xavier 21:46

Yeah, he used it so he couldn’t pay the mortgage. And the other one was he lost his job.

Jason 21:53

Sure, sure. And flipping the coin, can you walk me through a fairly recent, let’s say, success story. Someone who has purchased a VIP property?

Xavier 22:04

Last month I didn’t sell a VIP property to an expat. But I sold a house, a $125K house, and it was fun because the guy lives in the US, is married to an Ecuadorian and we worked together. We put a credit [application] together, we got qualified, pre-qualified, qualified and they say OK, that’s it. And then at the end of the day, when we were about to finish it, the bank forgot to send the form for the insurance. The insurance for the credit. And he filled it out and the guy had diabetes and they denied the credit. Can you believe that?

Jason 22:58

Because he didn’t have the insurance form?

Xavier 23:00

No. Because he got diabetes and he said, well…

Jason 23:06

Because they’re concerned that he’s not going to fulfill the loan because he’s got some health issues.

Xavier 23:10

Yeah, they were concerned about about it. And it was just diabetes type 2. He was not getting shots, just taking a pill. So I went into the bank and asked him why and well, they showed me the results of his blood test and he was bad. So we had this argument and negotiation with the bank. And we’d run new tests in the US. He was living in the US so blood test in the US, we got the paperwork here. Of course, he did it and he was taking his medication at this time and the credit was qualified later because he was in better shape. We had to do it.

Jason 24:01

So it was originally denied, but you provided some more evidence and then?

Xavier 24:04

Evidence and negotiation and well, we got it.

Xavier 24:08

Sure awesome. So that’s very, very helpful Xavier, I do appreciate it. Any last words of advice for those who are thinking about applying for a home loan here in Ecuador?

Xavier 24:18

Like an advice, well, just move to Ecuador, it’s wonderful. It’s a great place to live in Cuenca, in particular. In terms of credit, if you’re married, you can apply for it, but you’ve got to be married for at least six months. Just don’t get married to get a loan because they won’t, they will deny it.

Jason 24:38

So if you get married today, apply for a loan tomorrow, they’re going to be like, “Guys, come on. Yeah this is not…”. Come back within six months or they’re just going to say we don’t want to do business with you anymore?

Xavier 24:48

That’s going to go into your record and you don’t want to have that in your record when the time comes. It will show up.

Jason 24:57

Yeah, OK. Fair enough and so that’s great Xavier, thank you very much for sharing your experience on this crucial topic. And thank you, the YapaTree community for tuning in and if you do have any more questions or need further information, do feel free to get in contact with us. Links are in the description below. And of course, you can also view current property listings for sale and rent at yapatree.com Thank you very much, ciao.

One Response

This is a helpful and comprehensive article, thank you. There is a related article (in Spanish) in today’s Primicias focusing on some of the financial details of loans, which you can find here:

https://www.primicias.ec/primicias-tv/economia/intereses-seguros-impuestos-gastos-legales-compra-casa/