Some things take expats a while to figure out after they move here. One vexing (though unsexy) topic is how to pay for goods and services. Like many day-to-day practices, paying can be different here. So, this article is for those who want to save some time and maybe simplify their lives a bit. Even those expats who have been here awhile can learn something to streamline the way they pay.

As usual, I have seen a lot of Facebook posts on this topic that are unhelpful and come from a single, limited perspective that leaves out some good options. Questions posted on Facebook deliver lots of opinions but it is always difficult to distinguish the valid ones from the invalid ones.

To cut through the clutter, I leaned on some research with some local experts as well as my own experience and I hope you find the information helpful.

Check out the different options below: cash, debit card, credit card, bank transfers, direct card debit, banking websites, apps, etc, and decide which ones make sense for you by type of transaction.

Charging ahead…

Cash is King

Many business and personal transactions (taxis, hospital bills, food, utilities, personal services, appliances, etc) are settled in cash. This became very obvious quite quickly after I moved here and forced a change in my behavior because I fell in love with my debit card a long, long time ago.

In fact, cash discounts are frequently offered (even for hospital stays) so the vendor can save the usurious, bank card processing fees (4-8%).

Change is Hard

Regarding the change needed to transact business in cash, here is a nugget of wisdom: hang on to your small change whenever you can. You will need it because most merchants here behave as if it is the customer’s responsibility to carry change for both small and large purchases. So, what to do about this cultural peculiarity?

There are said to be change-making machines at the Central Bank near Museo Pumapungo and in some of the malls, though I think out of the many times I have tried to use them to break a $20, they didn’t deliver. Or you can stand in line at a bank to get change but I would personally prefer to stick a fork in my eye. Large supermarkets will make change from the register with your purchase, of course, but only before the cashier closes the register and frequently only in denominations that are convenient for them to give you, not what you want. You can try the customer service island but this is a 50/50 proposition at best. I have often been refused and rendered unable to tip the employee who wheels the cart out for me. So, none of the foregoing change-making methods have proven reliable for me.

Instead, I have found that doing regular business with my local tienda has entitled me to expect change for a $20 even for a $1.00 purchase.

One frequent use of cash is Taxis. Before you jump in a taxi with only larger denomination bills ($20 or bigger) do yourself and the taxista a favor and ask if he/she “tiene cambio para un veinte?” That will save some embarrassment for you at the end of your ride and prevent the taxista from becoming frustrated. If the taxista says “Si’” you can relax because he will make change for your $20 and many taxis now carry sufficient change for that. But ask first.

Debit Cards and Credit Cards

Getting Cash

The good news is that the major banks and cooperativas (especially JEP) have blanketed Cuenca with ATMs (cajeros) that spit out cash and perform most other banking services like balance checking, taking deposits, etc. I have found it relatively easy to fulfill my cash needs with JEP cajeros.

This is a common way for expats to get cash from their U.S. bank at a cajero. But the local banks (who operate the cajeros) have started extorting a $4-6 transaction fee for the convenience of making those cash withdrawals – regardless of amount. Of course, there are exceptions, like Charles Schwab accounts whose atm fees are waived or reversed by Schwab.

So, not all U.S. debit cards trigger this charge and you may discover ways to avoid it. However, many find that the trial and error of testing your card in the different institutions’ cajeros to find one that skirts those charges can be expensive and time-consuming. And the rules change across financial institutions, time, and location so what saves you the fee one day in one place may not do so the next day.

Without igniting a firestorm of comments and criticism about how to get cash and where to keep it, I will state that I strongly prefer saving bank fees by maintaining a substantial balance in my JEP account by transferring funds from my U.S. bank via international transfer websites that charge little.

International Funds Transfer – Simple and Cheap

If you don’t have a Schwab account or don’t want to pay $4-6 per withdrawal, you can transfer funds from your U.S. account to an Ecuadorian bank. It is quick and easy to use a funds transfer app (web or phone) like those from remitly.com, wise.com or Xoom (from Paypal) to quickly and cheaply (under 1%) transfer money to your Ecuadorian account or yourself in cash. My experience with remitly.com (link for free 1st transfer) has been excellent over the years and transfers frequently happen the same day or within 24 hours. This is way faster, cheaper and easier than withdrawing cash from one cajero with my US card and then physically depositing the cash in the cajero of my local account.

Credit Card Cash Advances

Getting a cash advance from your U.S. or Ecuadorian credit card is an expensive proposition, as each will usually charge you a $25 or greater convenience fee plus the interest on the amount you don’t pay off in the same billing cycle. But this approach has saved me a few times. It has been a good emergency maneuver but the cost-conscious will avoid it.

Making Purchases

Paying bills and making purchases by debit card (or credit card) has become more popular as convenience infiltrates the culture. But plastic is not always welcome for the reasons mentioned previously, even if the sticker on the merchant’s door says it is.

Where plastic is accepted, I have found that Ecuadorian debit and credit cards have served me better than my U.S. cards here. Paying with or withdrawing cash using an Ecuadorian debit or credit card does not add the frequent 1% international transaction fee on my statements that I get using a U.S. card.

Also, my U.S. bank likes to spring little surprises on me that reject random transactions as a security check which requires me to call them to verify my identity. It seems to happen at SuperMaxi even though I have been using my U.S. debit card there for many years. Anyway, you may find the 1% fee acceptable if your U.S. cards give you points but that’s for another day.

Paying “Servicios Básicos”

Paying your utility and other monthly bills in person is a popular method because you do not need Spanish. All you really need is enough cash, the name of the biller (eg. Centro Sur or ETAPA), the account number, or the billing code number. These numbers can be found on a paper bill or on the billers’ websites. So, I recommend you create and carry a list of both numbers by biller because having them means you can access, view, and manage your accounts online as well as pay your bills as needed.

Redactiva (Western Union) – In Person

The big benefits for many expats of paying at Western Union are the simplicity and convenience of paying all their billers once per month at the same time as well as services being offered at many locations. Also, payments are applied to your accounts immediately.

Visit Redactiva to see a complete list of billers payable when you bring the account number or billing code. No cedula is required. The office on Paucarbamba I visited indicated that the transaction fee per bill paid is $.79 and only cash is accepted.

And it seems they take payment for virtually every biller one might imagine and this list appears on their webpage at the link above. Of course, this list includes those most popular in Cuenca: IESS, light, water, internet, cell phone, cable TV landline and some credit cards.

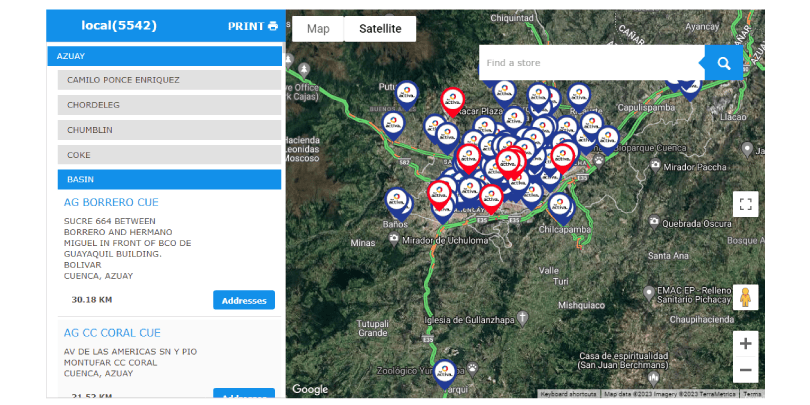

Find locations on this page. Scroll down until you find the menu on the left then select Azuay then Basin (Cuenca) to produce a map of many Cuenca Western Union Redactiva locations (red) and franchises (blue).

Several well-known Western Union locations include:

- Hogar de Esperanza Expat Service,

- El Centro Cuenca at the corner of Sucre and Borrero, and

- El Vergel at Paucarbamba and Rafael Torres Beltran which appear to be open until 5 pm.

Also in Mall del Rio, Batan Shopping, and Monay Shopping. The mall locations and others in “centros comerciales”, shopping areas like malls, are open until 8 pm.

To find one near you, click the link above then on one of the red or blue icons which will open a dialog box showing the address and directions (though the directions didn’t seem to line up with my GPS location).

Neither business hours nor a phone number are shown, so I recommend confirming their hours and exact location via Whatsapp (Spanish). Doing so worked well when I tried it. Click to Whatsapp Western Union: +593 99 751 5902

Servipagos

Servipagos is a division of Produbanco that takes payment for servicios basicos around Cuenca and the rest of Ecuador at its many different locations, as well as many other kinds of financial transactions (similar to Currency Exchanges in the US). Information about their services and locations is available on the Servipagos website. Some even have telephone numbers you can call beforehand (Spanish).

Pay on Biller Websites or at Their Branch Locations

The following billers’ websites provide information about paying your bill electronically on the sites as well as where to pay in person.

- Cell: Movistar, Claro, CNT – mobile apps are available.

- Electric/Light: Centro Sur – Enter the Cedula number of the account holder. Mobile app is available.

- Water and Internet: ETAPA

- Other internet and TV: Puntonet, Netlife, Celerity, XTrim

- IESS’s website does not appear to have a bill payment facility but the IESS Payment Page shows a variety of payment methods.

The Skinny on Electronic Payments

Pay Through Your Bank

This seems to be a somewhat less popular option than cash because it requires enough Spanish to set up payment and the patience to do so through their online system. But setting up to pay your billers is so worth it because of the time it saves and because it lets you stay current with your bills without being in Cuenca.

Electronically transferring funds from a local savings or checking account or through an attached debit or credit card is my preferred method because after you set up the biller accounts to transfer to, you can execute further electronic payments at any time and from anywhere in just a few minutes (or in no time at all).

Fully Automatic Mode

Some financial institutions have made it a seamless experience to pay directly from your account without ever looking at a bill. For example, JEP as well as Banco de Guayaquil, allow you to input account and billing code info for each biller. Then they handle all the rest, automatically paying each of them as they arrive from the biller, and then immediately report the payment to you. I love this feature and use it to pay all my bills except my rent which I pay through an electronic transfer to my landlord’s account.

Semi Automatic Mode

Also, most of the major financial institutions allow you to register your biller accounts online or via mobile apps and then transfer payments with a few clicks to billers. But you have to check for their arrival online and then click through the steps to make each transfer individually.

Using the 2 foregoing, automatic approaches, I have paid my bills while traveling and it has proven to be much more convenient than the other alternatives I shared.

Risky Automatic Mode

You can also register your bank account or card with most of the billers, permitting them to draft it with each billing cycle. But beware that some expats have found that once that info is registered in the billers’ systems, billers continue to draft it even after the expat cancels the service. There are quite a few documented cases of this practice so I do not recommend it.

Interbank Transfers – Easy to Use All the Time

In addition to electronic transfers to your regular billers, Interbank transfers are also an excellent cash alternative to quickly pay a friend or merchant. You just need their “datos bancarios” – the name of their financial institution, their account number, Cedula or RUC number, the name on their account, and their email.

One of the downsides of transacting in cash is that it can be hard to keep enough of it on hand. However, I find that most merchants are just as happy to accept a bank transfer as to be paid in cash. You can make transfers from your bank account quickly at any time and from anywhere with your computer or bank mobile app.

It takes less time than you may think to register a biller (beneficio) on your financial institution’s website or using their mobile app. I often do it for one-off purchases on the spot with my JEP phone app at restaurants or shops that don’t accept plastic, for example. Bank transfers have also come in very handy for me to pay individuals and businesses frequently or at least more than once.

As with automatic bill paying at JEP, for example, the cost for any individual transfer is just $.40, but it can be free if the merchant also uses a JEP account.

Help with Electronic Bill Paying is Available

If you aren’t comfortable with setting up billers in your bank’s online system or with doing it in Spanish, there is plenty of help to get you started and keep you going.

We checked with some of the bi-lingual facilitators featured in our recent article Cuenca Facilitators That Can Make Your Life Easier about setting up electronic bill paying and all of the following can assist you in doing so and several offered some comments.

Orlando Siguenza

Orlando can help you set up utility accounts and the best means of paying them electronically. He has experience paying bills for those expats who may be out of the country.

- Whatsapp: +593 985854587

- Facebook: www.facebook.com/orlando.siguenza.39

- Email: [email protected]

Victor Ojeda

Victor works full time facilitating a variety of tasks or his expat clients. His experience is the basis for a comment I made above that giving a biller your debit card or credit card number to maintain for monthly billing in their system may end up causing you headaches as they may bill you for months after you cancel your service. And persuading the biller and your financial institution to stop billing can be a time-consuming challenge. Those two things are hard for even an experienced facilitator to fix.

- Whatsapp (Ecuador): +593987313565

- Facebook: www.facebook.com/victor.ojeda.104

- Email: [email protected]

- Phone (US number): +1 347-606-4595

Summing Up

I covered a fair amount of territory so your options will hopefully appear clear.

I discussed different ways to pay: cash, debit card, credit card, bank transfers, direct card debit, banking websites and apps. As well as some benefits and disadvantages to each of them.

I like making payments electronically for ease and convenience – after I have them set up in my bank’s electronic banking system. And I have found the setup pretty easy to do on my own. But for those who are a bit uneasy with doing the setup (and in Spanish), I shared some bi-lingual facilitators you can contact to get you started.

One Response

You really put a great deal of time and effort into this article. It is extremely comprehensive and informative. I am an old timer when it comes to how to pay this or that, but the information here was so enjoyable to read, I did so anyway. I could not think of a single thing you may have missed.

Thank you for your hard work.