Editor’s Note

This article was contributed by Rick Snyder. Rick is a long-term resident of Cuenca and has been very generous with his time & effort in helping numerous causes that benefit the community. We’re grateful he’s happy to share his financial expertise with YapaTree readers and we trust you’ll benefit from it too.

It is true that you can get 10%+ annual interest on money deposited in Ecuador. But what’s the catch? How can they offer such high interest rates? It’s not actually that complicated. Ecuadorian financial institutions can pay much higher interest than those in the U.S. because they get much higher interest rates for money they lend out. This can be as high as 16%.

So, they can afford to offer higher rates and must do so to compete with other institutions for your investment dollars. But Certificates of Deposit (Depósitos a Plazo Fijo) rates vary wildly in Ecuador by sector and institution. In fact, not all CD’s are the same and not all pay 10%.

Below are tips to help you find the best CD for you.

What is a CD?

A CD is an investment for a fixed period that returns interest payments to the investor. The payment amount and interest rate usually increase with the amount invested, the time period of the CD and the market’s perceived risk of the specific institution and its financial sector.

The 3 financial sectors under Ecuadorian law are:

- Public banks

- Private banks; and

- Cooperativas.

Interest payments can be made at regular intervals over the life of the CD, upon maturity or even prepaid at the time of opening.

Both Bancos (Banks) and Cooperativas de Ahorro Y Crédito (similar to U.S. Credit Unions) offer CD’s, as well as checking and savings accounts. Banks typically offer lower CD interest rates because they are perceived as more secure while cooperativas offer higher interest rates because they are perceived as less secure.

Each institution sets its own minimum investment amounts, rates, terms, and early withdrawal policies and penalties, subject to Ecuadorian law.

We are providing you with some tips that will make you an informed CD shopper. But we did not conduct a comprehensive survey of all institutions and cannot recommend specific institutions or investing strategies. And, it is worth noting that we did not find much in the way of investment advice at the institutions we contacted.

Common CD Investment Strategies

One of the core reasons expats choose to invest in an Ecuadorian CD is to obtain residency. If you want an Inversionista Visa, you must invest in a 2 year CD(s) valued at $42,500 or at least that much in real estate property – just make sure the appraised value is over $42,500 & not just the sale value.

Or if your goal is to invest the maximum covered by Deposit Insurance from the government’s insurer, COSEDE, you can invest a total of up to $32,000 in one or more CD’s at a single institution and expect COSEDE to repay you up to that amount in the event of a forced closure.

The time period you choose should depend on how long you can comfortably go without accessing the funds invested.

Some common investment options:

- Invest for 12 months and let the CD rollover for another year; or

- Invest for 2 or more years to get higher interest payments and have the interest reinvested so it grows the value of the CD while interest earns interest (compounding).

Some like the idea of investing to earn enough interest income to actually live on. While it is true that you can invest $200,000 in CD’s at 10% interest yielding $20,000 per year, it may not be prudent to invest the majority of your capital in a single type of investment or at a single institution.

Many expats park just a fraction of their money in Ecuadorian CD’s to diversify some of their holdings at much higher rates than they could get in the U.S., while leaving the rest in US mutual funds, bonds or real estate, etc.

How Deposit Insurance works*

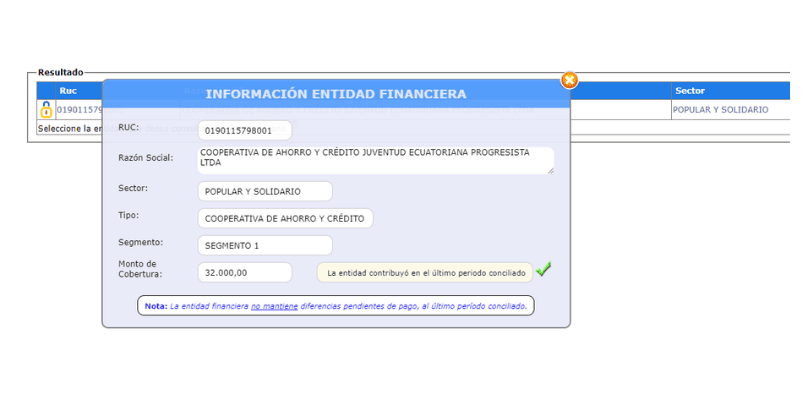

COSEDE is the Ecuadorian government’s Deposit Insurance arm that pays depositors up to $32,000 in the event of forced closure and they have a track record of doing so. And it helps to know that COSEDE also ensures that smaller investors are repaid before larger investors.

We were told by some representatives that total investments up to $32,000 per depositor are covered at:

- All major banks, e.g., Produbanco, &

- Large cooperativas (with over $80,000,000 in assets) like JEP, the largest in Ecuador.

But, we’ve received conflicting reports on whether $32,000 coverage is per sector, not per institution. We contacted several well-regarded lawyers in an effort to confirm the scope of this insurance. Unfortunately, there was no consistency so we cannot clarify this for you.

This has important implications for those wanting to maximize coverage for investments larger than $32,000.*

Also, deposit insurance coverage is much less than $32,000 at cooperativas with fewer than $80,000,000 in assets. Some small, localized institutions are not covered but those most familiar to expats are covered at the maximum $32,000.

Check whether an institution is insured and its level of COSEDE coverage here on the COSEDE website. The site also has good deposit insurance content including videos, online training courses plus lots of text translatable to English with tools like Google Translate or Chrome browser translation.

By the way, a closed institution must comply with its $32,000 COSEDE commitments AND repay investor deposits above $32,000. But there is no guarantee of the repayment amount nor a specific time period to receive amounts above the insured maximum of $32,000. And regardless of how much of your original investment is returned, you get no interest.

* There are some subtleties to Ecuador’s Inheritance law and its Deposit Insurance coverage that suggest some different strategies for designating beneficiaries and for CD investment strategies that will provide multiples of $32,000 coverage. We are researching these topics and expect to feature them in an upcoming article.

What my CD will pay and when

Interest rates vary from 2% to 14%. You can choose different combinations of the time period and investment amount from an institution’s standard product list or ask for one to be tailored for you. The combinations may be for as little as $100 for a month or as much as $100,000+ for 3.5+ years. Depending on the institution, you can often choose how frequently you receive interest: monthly, quarterly or annually, etc.

Here are some examples of total interest paid at the end of a 2 year, $32,000 CD compounded monthly:

- Major banks @ 4% = $5,202

- Cooperativas @ 8% = $8,119

Investors can also negotiate higher rates if they increase the amount or the time period invested.

Well-known institutions like those shown in this article offer online simulators to help you arrive at the interest amount you receive. Most show you their interest rate in the simulator, as you plug in the amount invested and time period. Some, like Cooperativa JEP, also post rates separately.

Some simulator examples are: Produbanco, Banco del Austro, Banco de Guayaquil, Cooperativa JEP, Cooperativa Policia Nacional, Cooperativa CREA & Cooperativa Cooperco.

Be aware that different simulators use different assumptions about the frequency of compounding and the frequency of interest payments. (e.g. monthly vs. annually) which makes a difference in the interest income calculation. So, to compare dollar returns across banks, you need to know the assumptions and adjust the outcomes on each simulator.

On the other hand, if you can get the applicable rates and assumptions, it can be easier to use a neutral simulator like the one below instead. Lastly, make sure to subtract the 2% from your total interest calculation for taxes that the institution will withhold for the government.

Make a shortlist of institutions

The article mentions just a few examples from dozens of institutions offering CD’s. We did not survey the market nor are we recommending any specific institutions.

But you can create your own shortlist based on the rates that support your investment objectives, as well as an institution’s total assets, risk rating plus the availability of English-speaking representatives (all those mentioned have at least one).

We do recommend that you select your CD investment institution separately from your choice for day to day cash and bill paying. You will find it easier to achieve your investment goals by focusing only on the investment and not on unrelated factors like proximity to your home or the size of the ATM network.

Your Risk Appetite

First, remember that CD’s from COSEDE-insured institutions are covered up to $32,000. The insurance mitigates the higher perceived risk of loss for amounts up to $32,000. In other words, if you invest in a less secure institution to get a higher rate of interest then factors like a lower asset level and a weaker risk rating may be less important to you in selecting an institution. Regardless, it is a good idea to check out each institution’s financial strength and it is easy to do.

For banks, gather information from Superintencia de Bancos

Get financial statements including assets, risk ratings and other useful information for banks at the bank regulator’s website, Superintencia de Bancos.

For cooperativas, gather details from SEPS

Use the following link to see if a cooperativa is regulated by SEPS Superintendencia de Economía de Popular y Solidaria. We recommend avoiding any unregulated institutions.

Financial institutions are evaluated by one or more risk rating agencies and institutions post rating certificates on their websites. Some, but not all, also post their financial statements on their websites but we also found them by Googling Informe de Gerencia (name of bank or cooperativa.) or by requesting the latest copy from a representative.

If you want to factor national finance into your Ecuador investment decision, you will find loads of info at places like Worldbank Overview & Economist Intelligence Unit

The obstacles, procedures and penalties for early withdrawal

If you invest in a 2 year CD for an Inversionista Visa, you can take the monthly interest but attorneys warn that liquidating before maturity is very difficult. And for non-visa CD’s, early liquidation is possible but can require legal assistance. Generally, unless you can document a medical emergency or some other very exceptional circumstance, early liquidation is painful, costly and unlikely.

Even if you are successful, be prepared to lose (at a minimum) the unpaid interest and the difference in the interest you would have earned at full maturity and the lower interest payable for the time you actually held the CD.

Get the policies and procedures in writing before you invest and remember they can vary by institution.

Rollovers

Institutions rely very heavily on deposits (vs. borrowing) to fund the loans they make and their operations. So, they love your deposits and resist your withdrawals. CD’s can have automatic rollover provisions. If you fail to notify them in time to prevent an automatic rollover, you may find it very difficult to access those funds because they have been reinvested.

If you miss your window, you may face challenges getting your money prior to your new maturity date. So, before you invest, specify whether an automatic rollover is acceptable. And regardless of the rollover rules you agree to, get them in writing and mark your calendar with a compliant notification date.

It may even be prudent to visit the institution a week before your maturation date just to double-check that this date is still correct. We have seen some reports from distressed expats that have inexplicably had their maturation dates changed by only a matter of days, but it’s enough to force the automatic rollover.

Beneficiaries

Determine who should receive your investments and can liquidate them quickly if you die. If an institution will not cooperate with you in adding a beneficiary’s name or co-owner’s name to your CD account, look elsewhere before investing. It is not unusual for depositors or their heirs to engage an attorney to take ownership and to liquidate a CD, especially when the depositor did not follow beneficiary designation requirements.

If you do not name a beneficiary, then Ecuadorian inheritance law will apply and your money may go to a family member other than who you want to receive it.

We recommend seeking advice from a competent Attorney when making your will to specifically cover what to do with your CD.

Final Words

CD’s are offered in a wide variety of shapes and sizes and can produce some surprisingly high interest income. But with higher rates can come higher risk and there are severe restrictions on liquidating early.

There are significant differences between financial institutions but deposit insurance from COSEDE protects a depositor up to $32,000. Just be careful putting all your investment eggs into one CD basket.

If you would like to speak to an English-speaking representative from the institutions in this article, you can contact us here and we’ll happily provide the referral.

13 Responses

Can you please tell me where you are getting your information that upper limit for the COSEDE insurance is $32,500 and not $32,000?

Asking an Ecuadorian attorney about COSEDE insurance is worthless. If you contact COSEDE directly they will explain that the insurance is per person per institution. The misinformation about it being limited by sector has been spread for years and has no basis in reality.

A great article about a topic that expats need to be more aware about.

Thanks for your great question and kind comment, Joseph. I got the $32,500 amount from Marcos Chiluisa, abogado at EcuaAssist. COSEDE did not respond to several written inquires but I will continue pursuing the amount and several other ambiguities with them for a future article.

I have had great success reaching COSEDE on Facebook Messenger. They have responded promptly to my inquiries.

The amount of the upper limit of the COSEDE insurance is even disclosed within your own article when you did a search for the coverage for Cooperativa JEP. Ecuadorian lawyers are the same as Forrest Gump describing chocolates.

Thanks for the interesting and helpful article. We have really struggled to find an English speaking representative at both Banco de Austro and Banco Guayaquil. I’ve tried WhatsApp, FB messenger, from the websites of both and trying to negotiate the phone prompts but my (very) limited Spanish has made this an exercise in frustration. How does one go about finding that person?

Thanks, Patty. Yes, those resources are a lot of work to find. I will email you privately with a few. Thanks for your kind remarks and question. – Rick

Hi, thanks for this very informative article. So am I understanding that even if we do not live in Ecuador we can still invest in Ecuador bank CDs and it would be insured? As an American expat living in Europe I know that we get double taxed or especially high capital gain taxes on many investment products but I’ve never looked into international CDs. Do you know what an American’s tax liability would be on this? I would like to invest in a CD but do not live in Ecuador (not yet anyway) nor speak Spanish. Do you have any advice on how to move ahead? Thank you very much.

Hi Cynthia – I believe Rick has sent you a detailed email with responses to your questions 🙂

Hi, Could I get that same info that Cynthia has?

Hi. How could I obtain information regarding how to invest in a CD in Ecuador from US? Is it possible without visiting Ecuador? Thanks.

Hi Damarys, to my knowledge you need to be physically present to open an CD account. One option would be to appoint someone here with a Power of Attorney to open on your behalf, but you’d want to trust this person completely.

Which banks are able to open a CD (póliza) for the purpose of using it to get an investor visa in Ecuador?

I read that many banks that will open a póliza are not valid for the investor visa.

The official documentation from “Ministerio de Relaciones Exteriores y Movilidad Humana (MREMH)” describing the process and requirements to obtain a investor visa in Ecuador specifically states the following requirement regarding the CD

> Título, póliza o certificado de depósito a un plazo mínimo de

> setecientos treinta días (730) días, emitido por una entidad

> crediticia reconocida por la Superintendencia de Bancos o

> Superintendencia de Economía Popular y Solidaria, por un monto

> equivalente y no menor a setenta (100) salarios básicos unificados

> del trabajador en general…

Or in English:

> Title, policy or certificate of deposit at a minimum term of seven

> hundred and thirty days (730) days, issued by a credit entity

> recognized by the Superintendence of Banks or Superintendence of

> Popular and Solidarity Economy, for an equivalent amount and not less

> than seventy (100 ) unified basic wages of the worker in general;

> either,

Source: https://www.gob.ec/mremh/tramites/concesion-visa-residencia-temporal-inversionista

Most specifically, I’m looking for the official list of banks published by the “Superintendencia de Bancos o Superintendencia de Economía Popular y Solidaria” that enumerates all of the banks that are approved to issue you a póliza specifically for the purpose of obtaining an investor visa.

Where can I find this list of approved banks?

Can you please contact me? I’ll be back in Ecuador in August and would like to invest in a CD.

We responded via email 🙂